THE PANCHAL BOYS NEED EDUCATIONAL SUPPORT

- theuntouchables

- Oct 12, 2020

- 1 min read

Updated: Oct 31, 2020

Update:

We had some difficulty to transfer the money to the school’s bank account. As the last date was drawing near we transferred the money to Daniel’s account and he has seen that it reaches the school. We have received a letter of appreciated from the twin boys father.

This particular project is over : Rs 6,000/-

Original Post

[The Panchal Brother’s Story is brought to us by our Intersex scout, Mx Daniel from Mumbai]

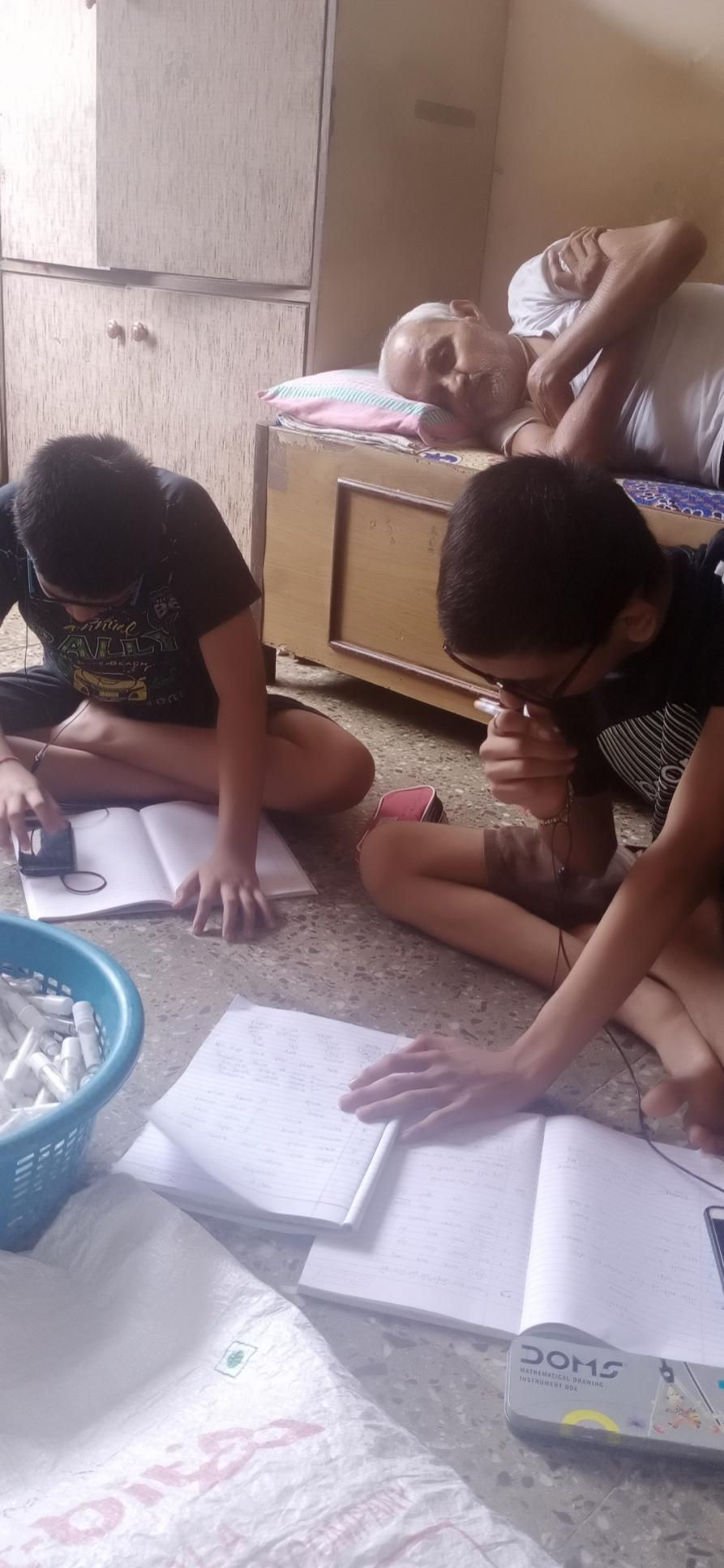

Prem and Parth Panchal are studying in JH Poddar school,[ J.H.Poddar High School & Jr. College, Shivsena Lane, X Road, Bhayander West in Mumbai. It is in Gujarati medium and they are currently in 10th std. They are 7 members in the family: Husband, wife, 2 daughters who have currently lost their jobs because of the pandemic, and these 2 sons who are in Std 10th. He oldest is their grandfather who is bedridden. The only earning member of the family is the father (Narendra Panchal)- his monthly income is 10000/-. They are not able to pay the fees this year and it's getting difficult for them to pay out the fees which is 4000/- for per child. I have managed to arrange Rs 2000/- and it would be great if you could assist with the balance

It would be great help if you could reach out to them. Wating to here for you [sic]

DONATION REQUIRED: Rs.6000/-to make up the balance of their annual fee

Comments